The Regulatory Compliance Burden That’s Draining Your Business

Let’s not sugarcoat it: compliance is a nightmare. You didn’t start your business so you could spend half your time buried in paperwork, trying to figure out whether you’re ticking all the right boxes for regulators. No one dreams of running a company that’s held hostage by red tape. But here’s the harsh truth: if you don’t get your compliance management in order, that dream business of yours could turn into a financial disaster.

For small businesses, compliance isn’t just a minor inconvenience—it’s a major headache. The more you grow, the more regulations pile up, and the more you’re stuck trying to keep track of workplace safety rules, tax filings, and industry-specific requirements that seem to change overnight. Whether you’re in construction, healthcare, or hospitality, compliance isn’t optional—it’s non-negotiable. But managing it manually? That’s a recipe for disaster.

According to Xero’s Small Business Insights, 43% of Australian small businesses have been hit with penalties for non-compliance in the last three years. Imagine that—nearly half of all businesses getting smacked with fines for missing deadlines or overlooking regulations. And it’s not just about the fines—it’s the time, the stress, and the risk of missing something that could sink your entire operation. Protecting customer data is crucial to maintaining customer trust and complying with regulatory frameworks, especially in industries dealing with sensitive information like finance and retail.

Here’s the thing: managing compliance manually is like running a marathon with a ball and chain around your ankle. You’ll move forward, but it’s slow, painful, and exhausting. And sooner or later, you’re going to trip.

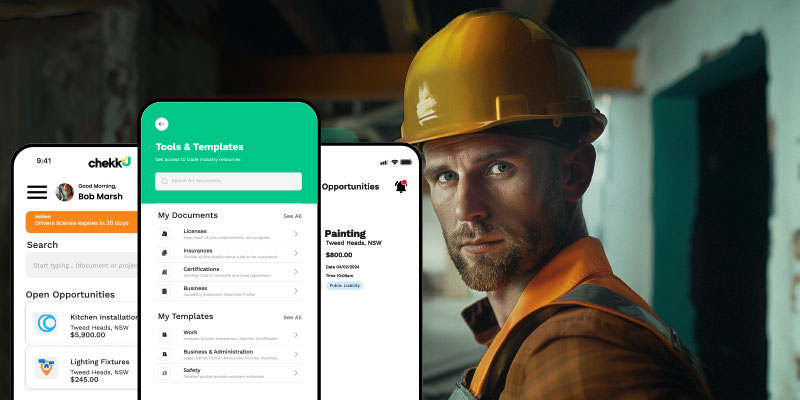

So, what’s the solution? It’s not to hire more staff or spend more hours on compliance—it’s to automate it. That’s where Chekku comes in. We’re here to take compliance off your plate so you can get back to doing what you’re best at—growing your business and making money, not playing regulatory catch-up.

Welcome to Chekku—your compliance requirement management solution that eliminates the stress and makes sure you never miss a deadline again. If you’re still doing compliance the old way, it’s time for an upgrade. We’ll show you why managing compliance with automation is not just a smart move—it’s essential for your survival.

The Problem with Manual Compliance Management

Let’s get one thing straight: manual compliance management is a disaster. I know some of you think you’ve got it under control—maybe you’ve got a stack of paper files in a drawer somewhere, or a spreadsheet that tracks your deadlines. But let’s be real—this approach isn’t just outdated, it’s dangerous.

You’re dealing with a mountain of rules and regulations—tax laws, workplace health and safety, industry-specific compliance, and data protection requirements like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). Somehow, you think a few Excel sheets and reminder emails are going to keep you on top of it all? You’re dreaming.

Why Doing It the Old-Fashioned Way Is a Disaster Waiting to Happen

Managing compliance manually is like juggling flaming swords. Sure, you might be able to keep everything in the air for a while, but eventually, one of those swords is going to drop—and when it does, it’ll take a chunk out of your business. To ensure regulatory compliance, it’s crucial to follow best practices, such as delegating compliance responsibilities among personnel and utilizing effective tools to support these efforts.

Here’s why manual compliance management doesn’t work:

- Time-ConsumingKeeping track of compliance deadlines manually means hours of paperwork, data entry, and endless checking and double-checking. You could be doing something productive, like building your business or focusing on your customers. But instead, you’re wasting precious time on a process that should be automated. According to Deloitte, businesses waste an average of 10-15% of their operational time on compliance management. That’s time you’ll never get back.

- High Risk of ErrorsThe more you handle manually, the more likely you are to make mistakes. And in compliance, mistakes are costly. Whether it’s a missed deadline, a misplaced document, or a miscalculation, the penalties can be crippling. The Australian Tax Office (ATO) hands out fines ranging from hundreds to thousands of dollars for late or incorrect lodgments. You think you can afford that? One slip-up, and you’ll be paying for it.

- No Real-Time VisibilityHow do you know you’re compliant at any given moment? You don’t. Without real-time tracking, you’re relying on outdated information, hoping you haven’t missed a regulation change. But hoping isn’t enough. Regulations are constantly shifting, and the longer you take to catch up, the more you’re risking. The OECD reports that over 135 regulatory updates are made each year in sectors like finance and construction alone. If you’re not tracking those updates in real time, you’re already behind.

The Old Way is Dead

So, why are you still doing things the old way? Maybe you think manual compliance management is “good enough.” Well, newsflash: it isn’t. It’s slow, it’s unreliable, and it’s costing you time and money that you could be using to grow your business. In 2024, relying on manual processes is like trying to keep your accounts in a ledger book—it’s outdated and ridiculous.

The Solution? Automation

Here’s the truth: manual compliance is dead. If you’re serious about your business, you need a system that works as hard as you do. That’s where Chekku’s compliance requirement management system comes in. It doesn’t forget deadlines, it doesn’t make mistakes, and it never leaves you wondering if you’re compliant. It’s time to stop wasting time and risking your business over something as simple as compliance management.

Enter Compliance Requirement Management Automation: Your Secret Weapon

Alright, enough about the problem—let’s talk about the solution. Because if you’re still stuck in the world of manual compliance management, you’re on the wrong side of history. The future is here, and it’s called compliance requirement management automation.

Now, before you roll your eyes and think this is just another buzzword, let me break it down for you. Automation isn’t some fancy tech jargon—it’s your ticket to a stress-free and fines-free business. And trust me, it’s simpler than you think.

Compliance Management Without the Headaches

Imagine having a system that keeps track of every regulatory change, every deadline, every report, and does it all without you lifting a finger. That’s what compliance requirement management automation is all about. For federal agencies, this means significantly improving information security and managing heightened regulatory demands. It’s the difference between scrambling to meet a tax deadline at the last minute or having the report auto-filed while you’re enjoying your morning coffee.

So, What Exactly Is It?

In simple terms, compliance automation means using technology to handle all those repetitive, mundane tasks that used to take hours of your time—and doing it better than you ever could manually. From tracking regulatory updates in real time to automating filings, compliance management automation takes the grunt work out of staying compliant.

Key Features That Make Compliance Automation a No-Brainer for Industry Specific Regulations

- Automated Regulatory UpdatesHere’s the thing—regulations change all the time, sometimes without warning. Whether it’s new tax laws, workplace safety requirements, or industry-specific standards like the General Data Protection Regulation (GDPR), keeping up with those changes is nearly impossible if you’re doing it manually. With automation, you get real-time updates. Your system tracks regulatory changes as they happen and ensures you’re always in the loop. No more relying on Google searches or hoping you didn’t miss an important update. According to McKinsey, businesses using automated compliance reduce risks by 30-40% just by staying on top of regulatory changes.

- Automated Filing and ReportingFiling compliance reports is a nightmare, right? Whether it’s for tax purposes, payroll, or health and safety, filing those reports manually is a chore. Compliance automation changes all that. Instead of spending hours gathering data, the system automatically generates and files reports based on your schedule. It’s like having an invisible compliance assistant who never sleeps. No more missed deadlines, no more scrambling to find documents—it’s all handled for you. According to Deloitte, businesses using automated reporting systems experience a 50% reduction in late filings and non-compliance penalties.

- Real-Time Alerts and NotificationsOne of the best parts about compliance automation is the real-time notifications. Got a deadline coming up? The system reminds you well in advance. Regulatory change you need to know about? You’ll get an alert. It’s like having your own compliance watchdog that never takes its eyes off the ball. According to Forbes, businesses that use real-time compliance alerts cut their risk of fines and penalties by over 60%.

Compliance Is No Longer a Headache—It’s a Breeze

Here’s the kicker: compliance management doesn’t have to be a hassle. With automation, you don’t just get rid of the stress—you actually start saving time, money, and sanity. Think about it: all those hours you used to spend on manual compliance? Gone. All the worry about missing deadlines or regulatory updates? Gone.

Automation doesn’t just simplify compliance—it empowers you to focus on what really matters: growing your business. Compliance no longer has to be the ball and chain dragging you down.

And the best part? You don’t need to be a tech genius to make it work. Chekku’s compliance management system is built for real people, not robots. It’s simple, intuitive, and designed to take care of compliance, so you don’t have to.

The Real Cost of Falling Behind on Compliance Requirements

Let’s cut to the chase—falling behind on compliance isn’t just a minor hiccup. It’s a full-blown disaster waiting to happen, and if you’re not taking it seriously, your business is at serious risk. Non-compliance isn’t just about fines (although those can be brutal)—it’s about your business’s reputation, your ability to operate, and ultimately, your survival.

What Happens When You Don’t Keep Up?

Compliance isn’t a “set and forget” deal. The second you stop paying attention, things start to slip. And when things slip, your business is playing with fire. Ignoring compliance or trying to manage it manually is like driving a car with no brakes—you’re asking for trouble.

Financial Penalties for Non-Compliance That Can Cripple Your Business

Let’s start with the obvious: fines. Regulatory bodies don’t mess around when it comes to compliance. If you miss a tax filing deadline, fail to follow health and safety protocols, or don’t comply with industry-specific rules, you’re going to get hit hard. Financial services companies, in particular, face stringent regulations and guidelines, such as SOC2 and the Gramm-Leach-Bliley Act, which demand effective security controls and systems. In Australia, the Australian Taxation Office (ATO) dishes out penalties for late or incorrect lodgments, and the fines can quickly pile up. For small businesses, those fines can range from $210 to thousands of dollars—all for something as simple as a missed filing deadline.

Now imagine that happening across multiple areas of your business—tax, payroll, workplace safety—pretty soon, you’re drowning in penalties, and that’s money straight out of your pocket.

Reputation Damage: The Silent Business Killer

But fines aren’t the only problem. Reputation matters. In today’s hyperconnected world, one compliance misstep can go viral faster than you can say “corporate negligence.” Clients, customers, and business partners don’t want to work with companies that can’t follow the rules. Publicly traded companies, in particular, face stringent regulatory compliance requirements imposed by acts such as Sarbanes-Oxley (SOX) and the Dodd-Frank Act. Trust me, one safety violation or a public tax penalty, and you’re not just paying fines—you’re paying with your business’s reputation.

According to PwC, 60% of consumers are likely to switch to a competitor after a single bad experience, and that includes compliance failures. So, what happens when word gets out that your business is dodgy with compliance? You lose clients, you lose trust, and eventually, you lose your business.

Missed Opportunities: The Cost of Inaction

And then there’s the opportunity cost. Every minute you spend trying to manage compliance manually is a minute you’re not spending on growing your business. Your competitors are using automation to stay ahead, while you’re stuck in the past, wasting time and resources on something that could easily be automated.

A report by Xero found that 30% of small business owners in Australia admit that compliance management takes up far more time than they can afford. That’s time you could be using to expand, innovate, and build relationships—but instead, you’re playing catch-up on outdated compliance processes.

The Verdict: You Can’t Afford to Fall Behind

Here’s the bottom line: falling behind on compliance isn’t an option. It’s not just about avoiding fines—it’s about protecting your reputation, your clients, and your future. Every day you delay automating your compliance management, you’re risking more than you think.

At Chekku, we make sure that never happens. With our compliance requirement management system, you’re always ahead of the game—no missed deadlines, no fines, and no damage to your reputation. It’s time to take compliance seriously and automate before it’s too late.

How Chekku’s Compliance Requirement Management Works

Let’s get one thing straight: manual compliance is dead. It’s slow, error-prone, and designed to make you feel like you’re drowning in paperwork. But there’s a better way. At Chekku, we’re flipping the script. Our compliance requirement management system is built to take all the stress and chaos of compliance and turn it into a streamlined, automated process that just works. No more guessing, no more stressing—just results.

Step-by-Step Breakdown of Chekku’s Automation Process

So, how does it work? Here’s the breakdown. Simple, right? But don’t be fooled—this simplicity is what makes it powerful.

1. Regulation Tracking: Always Stay Ahead of the Curve

Let’s face it, keeping up with changing regulations is like trying to hit a moving target. New tax laws, safety protocols, industry regulations—it’s enough to drive anyone crazy. But here’s the thing: with Chekku, you don’t have to do any of the legwork. Our system tracks regulatory updates in real time, ensuring adherence to all relevant laws and regulations pertinent to your industry, so you’re always up to date, no matter how often the rules change.

Imagine never having to trawl through government websites or legislation updates again. Chekku’s automation keeps an eye on things for you, ensuring you’re always compliant, no matter what the government throws your way. According to McKinsey, businesses that automate regulatory tracking cut their compliance risks by up to 40%. Those are odds you want on your side.

2. Automated Filing and Reporting: No More Missed Deadlines

Filing compliance reports manually? That’s a sucker’s game. If you’re still using spreadsheets or relying on emails to remind you of deadlines, you’re living in the past. With Chekku, filing and reporting is completely automated. Need to submit quarterly tax reports? Chekku has you covered. Got a safety audit coming up? No problem. Our system generates and files all the necessary reports for you, on time, every time.

The best part? It’s all done automatically. No more scrambling at the last minute, no more “oh crap, I forgot.” According to Deloitte, businesses using automated filing systems reduce their risk of late penalties by 50%. That’s time and money saved.

3. Real-Time Alerts: Compliance, Before It’s Too Late

What’s the point of managing compliance if you’re always behind the curve? With Chekku, you’ll get real-time alerts whenever something needs your attention. Whether it’s a regulatory change, an upcoming deadline, or a report that needs to be filed, our system makes sure you’re on top of everything before it becomes a problem.

These alerts don’t just keep you in check—they keep you ahead. No more surprises, no more last-minute scrambles. Just seamless, stress-free compliance. According to Forbes, businesses using real-time compliance alerts reduce their risk of fines by 60%. That’s what we call smart compliance management.

4. Customisation: Tailored Compliance for Your Business

No two businesses are alike, so why should your compliance system be one-size-fits-all? At Chekku, we get that every business has unique compliance needs. That’s why our system is fully customisable. Whether you’re dealing with tax compliance, health and safety, or industry-specific regulations, Chekku can be tailored to your business. It tracks what matters most to you, and nothing more.

This means you get a compliance system that works for your business—not some generic software that leaves you trying to figure out how to make it fit.

Compliance Doesn’t Have to Be Complicated

Look, compliance doesn’t have to be complicated—it doesn’t even have to be stressful. With Chekku, it’s easy. We’ve taken everything that makes compliance a nightmare and turned it into a system that does the heavy lifting for you.

The days of missed deadlines, regulatory panic, and manual filing are over. The future of compliance is here, and it’s called Chekku. We’re not just automating compliance—we’re making it painless.

Why Small Businesses Need Compliance Requirement Management Now

Let’s not sugarcoat it—small businesses are under more pressure than ever. You’ve got limited resources, a million tasks on your plate, and now you’re supposed to stay on top of compliance requirements too? It’s enough to make your head spin. But here’s the thing: compliance isn’t something you can afford to ignore. If you don’t have your house in order, one small slip could cost you your entire business.

You’re not a giant corporation with a team of lawyers and compliance officers who can spend their days tracking regulations. But guess what? You don’t need to be.

Compliance Isn’t Optional—But the Stress Can Be

Look, you can’t escape compliance. The Australian Taxation Office (ATO), Safe Work Australia, and your industry regulators aren’t going to give you a pass because you’re a small business. You have to play by the same rules as the big guys. But managing compliance manually? That’s a different story. That’s where small businesses fall behind—and that’s where Chekku comes in.

According to Xero, compliance takes up an average of six hours per week for small business owners. That’s six hours you could be spending growing your business, finding new customers, or actually enjoying your weekends. Instead, you’re stuck dealing with compliance paperwork, and for what? Just to avoid a fine? You can do better than that.

Small Margins for Error—Big Consequences

Here’s the reality: small businesses don’t get a second chance when it comes to compliance. One missed deadline, one overlooked regulation, and you’re staring down the barrel of hefty fines, legal action, and a ruined reputation. The ATO issues fines that start at $210 and quickly escalate, depending on how late or inaccurate your filings are. And don’t think the fines stop there—non-compliance can lead to lawsuits and business closure.

The problem is, small businesses operate on thin margins. You don’t have the luxury of making mistakes. The fines and penalties that big corporations can absorb? Those could cripple your business. You simply can’t afford to mess up.

The Compliance Load Is Growing: Data Protection Challenges

Think compliance is tough now? It’s only getting harder. According to Deloitte, regulatory requirements are increasing every year, especially in industries like construction, healthcare, and finance. Industry compliance regulations are vital frameworks that guide businesses in operating ethically and legally. What might have been manageable a few years ago is now a full-time job, and if you’re still trying to handle it all manually, you’re setting yourself up for failure.

Automation Is Your Only Option

Here’s the truth: you can’t afford to ignore compliance. But you also can’t afford to waste your time and resources trying to manage it manually. That’s where Chekku comes in. We take the compliance load off your shoulders so you can get back to what really matters—running your business. Protecting sensitive data and maintaining security standards are crucial for regulatory compliance. Compliance automation isn’t just a smart move—it’s a survival tactic. If you want your business to thrive, you need to automate now.

Compliance Management Doesn’t Have to Be Hard

Let’s get real: compliance doesn’t have to be the ball and chain dragging your business down. It’s 2024, and if you’re still managing compliance like it’s 1994, you’re doing it wrong. You didn’t start your business to drown in paperwork, miss deadlines, and stress about every little regulation change. No—you started it to build something great. And here’s the truth: compliance should never get in the way of that.

The good news? It doesn’t have to. Not anymore. With Chekku, compliance becomes effortless. Our system does the heavy lifting, making sure you never miss a deadline, never get hit with a fine, and never let compliance get in the way of your growth. We’re not just talking about saving you time—we’re talking about protecting your business from the kind of disasters that could cost you everything.

Why Chekku Is Your Secret Weapon

Let me break it down for you: Chekku isn’t just another tool in your business toolkit—it’s your secret weapon. It’s the safety net that catches compliance issues before they become disasters. It’s the smart system that does the thinking for you, tracking regulations, automating reports, and sending reminders, so you can focus on what you do best—running your business.

According to McKinsey, businesses that automate their compliance processes cut compliance-related risks by 40-50%. That’s real protection against the fines, penalties, and legal headaches that could otherwise wreck your business. Why wouldn’t you want that?

It’s Time to Get Smart—It’s Time to Automate

Here’s the deal: compliance doesn’t have to suck, but it does have to be done. You can either keep managing it the old way—losing time, losing money, and taking risks—or you can step into the future with Chekku and automate the whole process. The choice is yours, but let me tell you this: businesses that don’t automate are digging their own graves.

Don’t let compliance be the thing that holds you back. Don’t wait until you’re slapped with a fine or scrambling to meet a deadline. Automate now with Chekku, and take control of your compliance, your business, and your future.

The bottom line? Compliance doesn’t have to be hard, and with Chekku, it won’t be. The future is here—it’s automated, it’s seamless, and it’s waiting for you to step up.

FAQ’s

- How can plumbers and electricians avoid fines for non-compliance?

Plumbers and electricians need to stay updated on changing regulations regarding safety standards, work permits, and certifications. Failing to do so can lead to fines from bodies like the Australian Tax Office (ATO) or Safe Work Australia. By using Chekku’s automated compliance system, tradespeople can stay ahead of regulatory updates, track their certifications, and avoid the pitfalls of manual compliance tracking( - What qualifications are required to work as an electrician or plumber in Australia?

Electricians and plumbers must hold a valid license to work in Australia, which typically requires an apprenticeship, formal education, and passing relevant exams. They also need to maintain up-to-date certifications and meet safety compliance standards. Chekku helps by automatically tracking license renewals and certification deadlines, ensuring that you stay compliant without the hassle of manual tracking - How do plumbers and electricians detect issues in their systems?

For plumbers, tools like acoustic leak detectors and thermal imaging cameras are common for identifying hidden issues like leaks. Electricians use circuit testers and voltage meters. Keeping up with the latest tools and ensuring they meet compliance standards is crucial. Chekku ensures that tradespeople stay compliant by automating the tracking of equipment certifications and standards - What are the common compliance challenges tradespeople face?

One of the biggest challenges tradespeople face is staying compliant with shifting industry regulations. From safety standards to environmental regulations, managing this manually can lead to errors or oversights. By automating compliance tasks with Chekku, you can ensure that your business is always up to date with the latest requirements, reducing the risk of fines or project delays

Why is compliance important for small trades businesses?

Compliance isn’t just about avoiding fines—it’s about maintaining a trustworthy business that clients can rely on. Non-compliance can result in hefty fines, project delays, and reputational damage. Chekku helps small businesses by simplifying compliance management, ensuring that you’re always up to date with industry standards, licenses, and safety requirements