A compliance management system is essential for ensuring an business’s compliance with legal requirements, industry standards, and internal policies. It involves three tiers: organizational compliance, employee compliance, and external stakeholder compliance. A CMS helps ensure compliance, avoids instances of flouting the rules, and boosts an organization’s reputation. Effective compliance management is crucial for organizational success, and a CMS is a framework that helps organizations ensure adherence to legal requirements, industry standards, and internal policies. Implementing robust compliance management systems is key to enhancing an organization’s compliance efforts.

Compliance issues can arise unexpectedly, but with proper compliance monitoring, organizations can proactively identify and address these challenges, ensuring smooth operations and avoiding potential fines or disruptions.

Let’s not mince words: compliance is killing your small business. I know, I know—compliance isn’t the most exciting thing in the world. It’s not why you started your business. You’re in this game to make moves, make money, and maybe even change the world. But here’s the hard truth: unless you get compliance sorted, you’re playing a losing game.

If you’re like most small business owners, you’re probably wasting hours—no, days—trying to figure out if you’re meeting all the regulatory requirements. You’re manually tracking paperwork, stressing over deadlines, and praying you’re not missing something that could end in a fine or, worse, shut your business down. Sounds familiar, right? It’s a ticking time bomb, and trust me, when it blows, it’s not pretty.

Establishing clear compliance objectives is essential for managing your compliance program effectively. This ensures that your efforts are aligned with legal standards and organizational goals, making it easier to navigate the complex regulatory landscape.

Compliance isn’t optional. You can’t just throw your hands up and ignore it. Whether it’s tax compliance, employment law, health and safety standards, or data protection, you’re expected to know every single detail—even if it feels like the rules change every five minutes. And here’s the kicker: if you make a mistake, they don’t care if you’re a small business. The fines don’t shrink just because your team is five people instead of fifty.

Compliance requirements are constantly evolving, and the risks associated with non-compliance can be severe. Identifying and mitigating compliance risks is crucial for protecting your business and maintaining operational integrity.

Here’s a wild stat for you: Australian small businesses spend an average of $90,000 each year just to stay compliant. That’s money and time you should be using to grow your business, innovate, and, you know, actually enjoy running the thing.

The good news? There’s a way out of this compliance quicksand. It’s called compliance automation, and no, it’s not just for big corporations. It’s for you—the scrappy entrepreneur, the small business hustler, the one who’s ready to get ahead without the compliance nightmare hanging over your head. By the time we’re done here, you’ll wonder why you didn’t automate sooner.

Compliance training is vital for ensuring that your team understands and adheres to compliance procedures. Continuous monitoring further helps in identifying gaps and taking timely corrective actions, thus maintaining compliance.

An effective compliance management system is essential for modern regulatory demands. It enhances your organization’s compliance efforts by automating processes and continuously improving compliance strategies.

So buckle up. We’re going to show you exactly how compliance automation is the secret weapon you didn’t know you needed. And no, it’s not just for ticking boxes—it’s for keeping your business alive, compliant, and ready to grow. A successful compliance management system is foundational to achieving this, ensuring that your business remains compliant and thrives in a competitive environment.

The Old-School Way: Manual Compliance Is a Time-Sucking Nightmare

Let’s get one thing straight: if you’re still handling compliance manually, you’re stuck in the dark ages. Yeah, I said it. It’s 2024, and the fact that some businesses are still wading through paper forms, spreadsheets, and sticky notes to track compliance blows my mind. But here’s the real kicker—every time you think you’ve got it sorted, some new regulation pops up and you’re back to square one. It’s a never-ending game of regulatory whack-a-mole, and guess what? The hammer’s getting heavier every day.

Imagine this: you’re a small business owner, hustling hard to grow your brand, but instead of focusing on innovation, your week is spent combing through outdated regulatory guides, updating employee training logs, and hoping—no, praying—you don’t miss a deadline. Maybe you even set reminders on your phone, but come on, how many notifications can you manage before something slips through the cracks?

Here’s the hard truth: manual compliance isn’t just a headache—it’s a disaster waiting to happen. One missed deadline, one unchecked regulation, and suddenly you’re facing fines that could cripple your business. According to a PwC Australia report, businesses spend an average of 5-10% of their operating costs just managing compliance risks, and most of that is wasted on inefficient manual processes. Think about that—10% of your budget wasted just trying to keep up with the rules.

How It’s Hurting You

Every minute you spend managing compliance manually is time you’re not addressing compliance issues and not spending on growing your business. It’s that simple. Let’s break it down:

- Time Wasted: Small business owners spend hours—sometimes days—every month on compliance tasks. That’s time that could’ve been used to develop new products, market your services, or actually talk to your customers.

- In fact, the OECD found that overregulation and cumbersome compliance processes are one of the biggest obstacles to business innovation and growth.

- Risk of Human Error: You’re human. I’m human. We all make mistakes. The problem with manual compliance is that every manual entry, every forgotten deadline, is a potential fine or, worse, a lawsuit. Don’t believe me? Just look at the ATO’s penalty guidelines—if you fail to report on time, fines can run up to thousands of dollars. And trust me, they don’t care if you “forgot.”

- Lack of Real-Time Visibility: Manual compliance is like trying to steer a ship with a blindfold on. You think everything’s fine, but in reality, you’ve got no idea if you’re on track. Until you hit an iceberg. With manual systems, you have no real-time oversight—by the time you catch a problem, it’s usually too late.

It’s 2024—Why Are You Still Doing This?

Here’s the thing—manual compliance is slow, risky, and frankly, outdated. Why are you still clinging to the old ways when automation and continuous monitoring could save you time, money, and sanity? It’s like choosing to ride a horse when you’ve got a brand-new car sitting in your driveway. The world has moved on, and so should your compliance strategy.

Let me hit you with another stat: businesses that switch to compliance automation cut their compliance management costs by 40-50%, according to research from Deloitte. That’s real money saved, and the best part? You’re no longer tied down by the chains of manual processes.

Enter Compliance Automation: Your Secret Weapon

Alright, here’s the deal—manual compliance is a disaster, but I’m not here just to complain about the problem. I’m here to tell you how to fix it, and trust me, compliance automation is the secret weapon you didn’t know you needed. This isn’t some techy buzzword to throw around at networking events. No, this is real, tangible help that’ll save your business from drowning in paperwork and fines.

You’re probably asking, “But what the hell is compliance automation anyway?” Well, let’s break it down in no-BS terms: compliance automation takes all those mind-numbing tasks you’re doing by hand—tracking regulations, checking deadlines, submitting reports—and automates them. It’s like having a digital assistant who’s a compliance expert, and unlike your average employee, it doesn’t make mistakes, doesn’t forget deadlines, and works 24/7 without a coffee break. Implementing an effective compliance management system (CMS) is crucial here. A well-designed CMS helps organizations avoid non-compliance issues, adapt to evolving regulations, and enhance their overall compliance processes through automation and continuous improvement.

Why It Matters: Automation Isn’t a Nice-to-Have, It’s a Must-Have

Let’s be clear—compliance automation isn’t just a luxury for big corporations. Establishing clear and measurable compliance objectives is an absolute must for small businesses that are struggling to keep up with a mountain of regulations. According to a McKinsey study, businesses that adopt automation see a 30-40% increase in efficiency and a significant reduction in errors. Think about that—less time wasted, fewer mistakes, and more time spent growing your business.

Here’s why it should matter to you:

- Save Time, Focus on GrowthHow many hours are you wasting on compliance every week? Five? Ten? Maybe more? Every minute you spend on compliance is a minute you could be using to grow your business. Compliance automation handles the grunt work for you. Regulations change? No problem—your system updates automatically. Got a report due? It’s already generated, filed, and done. You just get on with running your business.

- Cut Human Error Out of the EquationLet’s face it—humans make mistakes. It’s in our DNA. But when it comes to compliance, even a small mistake can lead to big penalties. Miss a deadline? That’s a fine. Forget to submit a report? You’re on the hook. With compliance automation, the risk of human error is gone. Forbes reports that companies using automation tools reduce compliance mistakes by up to 60%. That’s the kind of security small businesses need.

- Stay Ahead of Changing RegulationsRegulations don’t stay the same forever. They change, and sometimes it feels like they’re changing just to keep you on your toes. Keeping track of those changes manually is a nightmare. A robust compliance program within your compliance management system doesn’t just track these changes for you—it applies them. Real-time updates mean you’re always ahead of the game, never caught off guard by new rules.

Automation is the Future, and You Need to Catch Up

Here’s the thing—if you’re not automating your compliance, you’re already behind. The future of business is automated, and compliance is no exception. Continuous monitoring is crucial for minimizing compliance risks and facilitating regular assessments of legal regulations, organizational vulnerabilities, and adherence to standards. Look around—companies everywhere are streamlining their operations with automation. In fact, a Gartner report predicts that automation will replace 69 million jobs by 2025. It’s not just coming—it’s here.

The businesses that are automating now are the ones that’ll be standing in five, ten, twenty years. The ones that are still doing things the old way? Well, let’s just say they’re going to be left in the dust.

So if you’re ready to stop wasting time, stop risking fines, and start focusing on what really matters—growing your business—it’s time to embrace compliance automation. You don’t have to wait until you’re drowning in paperwork or facing your next fine. You can start now.

The Real Cost of Manual Compliance: You’re Bleeding Money and You Don’t Even Know It

Let’s get one thing straight: if you’re still handling compliance manually, you’re not saving money—you’re bleeding it due to unaddressed compliance risks. I know what you’re thinking: “But manual compliance doesn’t cost me anything.” Wrong. Just because you’re not paying for fancy software doesn’t mean it’s free. In fact, the hidden costs of manual compliance are so high, especially when considering evolving compliance requirements, they’re likely dragging your business down faster than you realise.

Think You’re Saving Money? Think Again.

Here’s the truth: manual compliance is an expensive illusion. Every hour you (or your team) spend sifting through paperwork, updating spreadsheets, or chasing down compliance deadlines is money down the drain, hindering your compliance efforts. Small businesses waste an average of 240 hours per year just on compliance, according to Business News Australia. That’s 30 working days a year—you could be using that time to grow your business, develop new products, or, I don’t know, take a holiday for once.

And it gets worse. PwC reports that businesses lose 5-10% of their total revenue managing compliance manually. That’s money you’re throwing away just to keep up with regulations that change constantly. Let that sink in for a minute—5-10% of your revenue gone, and what do you have to show for it? More paperwork? Another late report?

Human Error: The Hidden Compliance Risks Money Pit

Let’s not forget about the human factor. Look, we’re all human—we make mistakes. But when it comes to compliance issues, those mistakes cost you big. Whether it’s a missed deadline, an incomplete report, or an overlooked regulation, one tiny slip-up can result in thousands of dollars in fines. According to Deloitte, compliance penalties have increased 45% over the past five years. And here’s the kicker: they’re not coming down anytime soon.

Think a little human error won’t hurt you? Ask anyone who’s been slapped with a fine from the ATO. Forget to lodge your compliance documents on time, and the penalties can run into the thousands. Now, tell me again how you’re saving money with manual compliance.

The Cost of Lost Opportunity

But it’s not just about the fines and wasted time. Let’s talk about opportunity cost. Every hour you or your team spends on compliance is an hour you’re not spending on what really matters—growing your business. Instead of strategising, developing new products, or finding new clients, you’re buried in compliance tasks that could easily be automated with proper compliance training.

And let’s be honest—compliance isn’t your passion. It’s a necessary evil. So why are you letting it take up valuable time that could be spent doing what you actually love?

You Can’t Afford NOT to Automate

Here’s the hard truth: manual compliance is costing you far more than automation ever will. Businesses that switch to automation reduce their compliance management costs by 30-50%, according to McKinsey. Think about that: half the cost, half the time, and zero stress. Automation also enhances compliance monitoring, identifying gaps, measuring performance, and ensuring adherence to policies and regulations.

So, tell me again—why are you sticking with manual compliance? If you’re serious about your business, about your future, you can’t afford NOT to automate. It’s not just about ticking boxes—it’s about freeing up time, saving money, and making sure your business doesn’t get strangled by its own red tape.

How Compliance Automation Works: The No-Bull Breakdown

Alright, you’ve heard enough about why manual compliance is a disaster and why a compliance program is the way forward. But let’s be honest—you’re probably wondering how the hell this automation thing actually works to meet compliance requirements. Don’t worry, we’re not going to hit you with a bunch of tech jargon that leaves you more confused than when we started. Let’s break it down Chekku-style—simple, no-bull, and straight to the point.

Step 1: Regulation Tracking—Because the Rules Are Always Changing

Regulations change. That’s a fact of life. And keeping up with those changes is like trying to keep track of the weather—good luck doing it manually. With compliance automation, the system tracks regulations in real-time, so you’re always up to date. Compliance monitoring plays a crucial role in identifying gaps, measuring performance, and ensuring adherence to policies and regulations. Whether it’s new tax laws, health and safety standards, or environmental compliance, the software is on top of it.

Think about it—if you’re managing regulations manually, you’re already behind. According to Harvard Business Review, businesses face an average of 135 regulatory updates each year. That’s more than two updates per week. How can you possibly keep up with that on your own? Spoiler: You can’t. But with automation, you don’t have to.

Step 2: Reporting and Filing—No More Missed Deadlines

We’ve all been there—scrambling at the last minute to file reports, hoping you haven’t forgotten some crucial detail. One missed report can land you in serious hot water due to non-compliance with evolving compliance requirements. Automation takes care of all that. Reports are generated, filed, and stored automatically. No more hunting for the right form, no more late submissions. The system does it for you—like clockwork.

According to PwC, businesses that automate their reporting processes reduce late filings by 50%. That’s half the stress and none of the risk.

Step 3: Compliance Monitoring and Notification System—Real-Time Alerts Before It’s Too Late

Let’s talk about accountability. You can’t always rely on your memory to remind you of every compliance deadline. Compliance automation systems send you real-time alerts when something needs attention—whether it’s an upcoming report, a new regulatory change, a task that’s due, or identifying and mitigating compliance risks. It’s like having a compliance manager in your pocket, except this one never drops the ball.

Here’s a stat that’ll hit home: A study by Deloitte found that businesses using automated compliance systems experienced a 70% reduction in missed deadlines. That’s 70% less stress for you and your team.

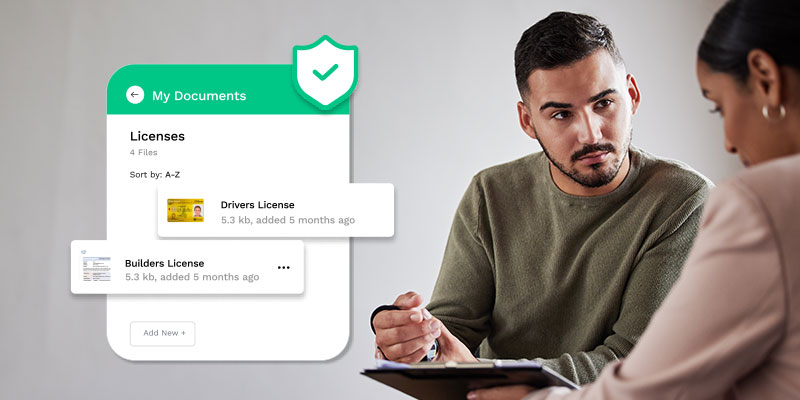

Step 4: Cloud-Based Accessibility—Compliance at Your Fingertips

In the old days, compliance meant stacks of paper files, spreadsheets, and someone who “sort of” knew where everything was stored. Not anymore. With cloud-based compliance automation, you can access everything you need, anytime, anywhere. Whether you’re at the office, on-site, or halfway around the world, your compliance system is right there with you.

This is especially important for small businesses. You might not have an in-house legal team or compliance officer on standby. But with cloud-based automation, you don’t need one. According to Gartner, cloud-based compliance systems improve accessibility and reduce the complexity of managing compliance by 50%. Compliance training is also simplified, ensuring that staff members are equipped with the latest knowledge and understanding of regulatory requirements to minimize risks of non-compliance. You’ll never have to wonder if you’ve filed something correctly again—it’s all there, instantly accessible and up-to-date.

A Compliance Management System Isn’t Just an Upgrade—It’s a Game-Changer

Let’s be real—this isn’t just a tech upgrade. Compliance automation is a complete game-changer. Implementing an effective compliance management system is not about ticking a box; it’s about freeing yourself from the burden of constant regulation tracking, reporting, and filing. It’s about eliminating human error and staying ahead of the curve in a world where regulations change more often than your favourite TV show gets cancelled.

And here’s the best part—you don’t need to be a tech genius to use it. The system is designed to work for you, not the other way around. It’s simple, effective, and, most importantly, it works. If you’re serious about running a successful, stress-free business, it’s time to ditch the old-school manual methods and embrace the future.

Why Small Businesses Need Compliance Automation More Than Ever

Let’s cut straight to the chase: if you think compliance automation is just for big corporations, you’re dead wrong. Small businesses need it more than anyone else. Why? Because you’re playing with a smaller margin for error. One mistake, one missed deadline, or one regulatory misstep in your compliance efforts, and your entire business could be at risk due to compliance risks.

Think Compliance Isn’t Your Biggest Problem? Guess Again.

Let me guess—compliance isn’t at the top of your list of priorities, right? You’ve got marketing, sales, product development, and about a million other things to juggle. But here’s the problem: compliance doesn’t wait until you’re ready. It’s like a ticking time bomb, and if you don’t stay on top of it, it’s going to explode in your face.

According to ASIC, small businesses in Australia face growing compliance pressure, with an ever-increasing number of regulations, particularly around tax, employment, and environmental standards. Establishing clear and measurable compliance objectives is crucial to effectively manage these compliance efforts, ensuring alignment with legal standards, industry practices, and organizational goals. That’s a full-time job on its own, and let’s be real—you don’t have the time or the headspace to deal with that on top of running your business.

Small Businesses Can’t Afford to Screw Up

Unlike big corporations with entire teams of lawyers and compliance officers, you can’t afford to screw up. One wrong move, and the penalties for compliance issues could cripple you. The ATO doesn’t care if you’re a small business—they’ll still hit you with fines for missing a deadline. And we’re not talking about a slap on the wrist. Fines can run into the thousands.

A recent Xero report revealed that 76% of small businesses find compliance to be one of the most challenging aspects of running their business, and 43% say they’ve been hit with penalties for non-compliance in the past three years. That’s nearly half of all small businesses getting fined—and for what? Forgetting to file some paperwork? That’s not a risk you can afford to take.

The Compliance Obligations Load Is Only Getting Heavier

Here’s the kicker: the compliance burden is only going to get worse. With new regulations popping up like mushrooms after a storm, keeping track of all the compliance requirements is nearly impossible. And here’s the thing—if you’re not using compliance automation, you’re already falling behind. According to Deloitte, the number of regulations businesses have to comply with is growing at an unprecedented rate, and it’s the small businesses that are feeling the pressure most.

Automation is the only way to keep up with this ever-growing mountain of regulations. It’s not about getting ahead anymore—it’s about surviving. If you want to avoid fines, stay compliant, and focus on growing your business, you’ve got to automate.

Automation Levels the Playing Field

Here’s the bottom line: compliance automation levels the playing field. Big corporations aren’t the only ones who can afford to stay compliant without pulling their hair out anymore. Automation makes it possible for small businesses to play on the same field—without needing an army of lawyers or a compliance officer, thanks to an effective compliance program.

When Compliance Failures Cost Real Money

Let’s look at the cold, hard reality of what happens when compliance goes wrong—no more hypotheticals. Meet Queensland-based construction company****Cavpower. This isn’t a small, scrappy business—it’s a big name in construction. But even the big guys can get caught out when compliance is pushed to the back burner.

In 2018, Cavpower was slapped with a $250,000 fine for breaching workplace health and safety regulations. This wasn’t just a case of a missed deadline or a forgotten piece of paperwork—this was serious. A worker was seriously injured, and the investigation found that the company hadn’t followed safety protocols required under Australian law.

You’d think a company of that size would have it all figured out, right? Wrong. The failure to comply with safety regulations not only resulted in a massive fine, but it also hurt their reputation, delayed projects, and cost them a hell of a lot more in legal fees. Safe Work Australia doesn’t mess around when it comes to breaches, and this was a prime example of how compliance risks can’t be an afterthought.

How Automation Could Have Changed Everything

Now, imagine if Cavpower had a compliance automation system in place. Every safety protocol, every regulatory update, every piece of paperwork would have been tracked, filed, and flagged before a disaster happened. Real-time alerts and compliance monitoring would have notified management about safety concerns long before that accident occurred. Instead of relying on manual processes—and human memory—the system could’ve ensured compliance at every step of the way.

Compliance automation would have saved them from that hefty fine and the long-term damage to their reputation. According to a Deloitte report, businesses that implement automated compliance reduce their risk of penalties by up to 70%. Cavpower could have been one of those businesses, but instead, they paid the price.

The Lesson? Don’t Wait Until Disaster Strikes

Cavpower isn’t the only Australian company to get burned by compliance failures, but they’re a perfect example of why automation is not negotiable. Don’t wait until you’re facing a six-figure fine, legal fees, or worse—a disaster that harms your employees. Compliance training is necessary for fostering a culture of compliance within organizations, ensuring that staff members are equipped with the latest knowledge and understanding of regulatory requirements to minimize risks of non-compliance. Automate your compliance now, or get ready to deal with the fallout later.

Think of automation as your secret weapon. It frees up your time, reduces the risk of human error, and makes sure you’re always compliant, even when the rules change overnight. Without it, you’re running a dangerous game of chance.

So, what’s it going to be? Stick with the outdated, manual systems that are draining your time and energy—or take the plunge and automate before it’s too late? Because here’s the truth: if you’re not automating, you’re not just behind the times—you’re in real danger of getting left behind completely.

The Future of Compliance: Get on Board or Get Left Behind

Let’s be real—the future of business is automation. And when it comes to compliance, there’s no room for dinosaurs. If you’re still handling compliance manually, newsflash: you’re already behind. Compliance regulations are getting more complex, and manual systems simply can’t keep up. You can try, but here’s the thing—you’ll lose. Sooner or later, you’ll miss a deadline, skip over a regulation, or make a mistake that will cost you big time.

We’re not talking about a minor shift here. The world of compliance is changing fast, and businesses that don’t adapt are going to get left in the dust. Implementing an effective compliance management system is crucial to avoid non-compliance issues and adapt to evolving regulations. Gartner predicts that by 2025, 70% of organisations will have fully automated their compliance functions to cope with rising regulations. If you’re not part of that 70%, you’re not just old-school—you’re obsolete.

The Growing Burden of Compliance

In Australia alone, businesses face a mountain of compliance obligations, from tax laws to workplace safety standards. As KPMG points out, the regulatory landscape is becoming more stringent, with new compliance requirements being introduced every year. This isn’t a trend that’s going to slow down. If anything, it’s speeding up. More regulations mean more complexity, and more complexity means more opportunities for things to go wrong.

Can you really afford to risk it? The Australian Small Business and Family Enterprise Ombudsman found that compliance costs Australian small businesses an average of $90,000 annually. And with those costs rising, manual compliance systems just can’t keep up. The businesses that embrace automation are the ones who will survive and thrive in this new era of constant regulatory change.

Why Automation Isn’t Just About Survival—It’s About Growth

Here’s the thing: compliance automation isn’t just about avoiding fines (though that’s a huge part of it). It’s about growth. The time and money you save by automating your compliance processes are time and money you can invest back into your business. Establishing clear and measurable compliance objectives allows you to effectively manage your compliance efforts, ensuring alignment with legal standards, industry practices, and organizational goals. While your competitors are stuck in the past, drowning in paperwork and scrambling to meet deadlines, you’re focusing on innovation, growth, and getting ahead.

Let’s face it: the businesses that automate are going to be the ones that lead their industries. They’ll be more efficient, more agile, and more prepared to deal with the next wave of regulatory changes that are surely coming. It’s not just about keeping your head above water anymore—it’s about swimming laps around the competition.

A McKinsey report found that businesses that adopt next-generation compliance automation see a 30-40% increase in efficiency and a significant reduction in compliance-related errors. That’s the difference between businesses that thrive and businesses that get bogged down by red tape.

The Future of Compliance is Automated—Period.

Here’s the bold truth: If you’re not automating your compliance, you’re setting yourself up to fail. The future is already here, and businesses that are serious about growth, about innovation, and about surviving in an increasingly complex world of regulations must automate and incorporate compliance monitoring.

Think about it: would you drive a car without power steering? Would you use a typewriter in 2024? Of course not. So why are you handling compliance like it’s still 1995? It’s time to evolve. Compliance automation isn’t just an upgrade—it’s the new standard. And if you’re not on board, you’re not just behind—you’re about to be left behind entirely.

The choice is yours: stay stuck in the past and risk becoming irrelevant, or embrace automation and ensure your business not only survives but thrives in the future. Because here’s the truth—manual compliance is dead, and the businesses that don’t automate are digging their own graves.

Compliance Doesn’t Have to Suck

Let’s not beat around the bush—compliance is a pain. No one starts a business because they love dealing with red tape and regulations. But here’s the thing: compliance doesn’t have to suck. If you’re still handling compliance manually, you’re stuck in the dark ages, wasting time, energy, and money on processes that can be fully automated.

Compliance automation isn’t just the future—it’s the present. It’s what separates businesses that thrive from those that drown in paperwork and fines. According to Deloitte, businesses that embrace compliance automation reduce their risk of penalties by up to 70% and free up valuable time for growth and innovation. Additionally, integrating compliance training ensures that employees and management are well-versed in compliance procedures, fostering a culture of compliance and minimizing risks of non-compliance.

The choice is simple: automate or fall behind. It’s time to stop treating compliance like an afterthought. It’s time to embrace the future and focus on what really matters—growing your business.

Automate with Chekku—Because You Deserve Better

Here’s the deal: compliance automation isn’t just about avoiding fines or keeping regulators off your back. It’s about taking control. It’s about putting your business back in the driver’s seat, where it belongs.

At Chekku, we know what it takes to help businesses break free from the endless compliance grind. We’ve built a system that works for you—automating the boring, repetitive tasks so you can focus on the big picture. Our compliance program serves as the control center for compliance policies, processes, and audits, ensuring you stay ahead of regulatory changes and guiding your staff in adhering to compliance standards. Don’t just take our word for it. According to Forbes, businesses using automation to manage compliance see an average increase in efficiency of 30-40%.

Still think manual compliance is “good enough”? Think again. The world is moving fast, and businesses that don’t automate are getting left in the dust. PwC reports that businesses adopting automation experience significant reductions in errors and operational costs. Those aren’t just buzzwords—they’re the cold, hard truth.

It’s Time to Get Smart—It’s Time to Automate

If you’ve made it this far, you already know what the next step is. The question isn’t whether you should automate your compliance—it’s why you haven’t already. Manual processes are dead, and the businesses that cling to them are headed the same way.

At Chekku, we’re not here to offer you half-baked solutions or gimmicks. We’re here to help you get ahead, to make compliance something you never have to worry about again. We’re here to free you up to do what you do best—run your business.

It’s time to stop wasting your valuable time on compliance efforts. It’s time to stop living in fear of missed deadlines, regulatory changes, and surprise fines. It’s time to automate with Chekku.

So, what are you waiting for? Make the smart move. Automate your compliance today and start focusing on what really matters—growing your business.

Frequently Asked Questions:

What is compliance automation?

Compliance automation uses technology to streamline regulatory compliance tasks, such as tracking regulations, submitting reports, and managing deadlines. Chekku’s platform offers this for small businesses, helping them stay compliant effortlessly.

Why is compliance important for small businesses?

Small businesses face strict regulatory requirements, and non-compliance can result in hefty fines. Chekku simplifies compliance management, ensuring businesses avoid penalties and stay up-to-date with evolving regulations.

How can I reduce compliance costs for my business?

By automating compliance processes, businesses can reduce manual labor and errors, which can significantly cut compliance costs. Chekku helps small businesses save time and money through automation.

What happens if a business fails a compliance audit?

Failure to pass a compliance audit can lead to penalties, legal issues, and loss of reputation. Chekku helps prevent this by ensuring all compliance requirements are met through real-time monitoring and alerts.

How can I stay on top of changing regulations?

Compliance regulations frequently change, making it difficult to stay compliant manually. Chekku provides real-time updates on regulatory changes, helping businesses stay ahead of the curve.

What are the risks of manual compliance management?

Manual compliance management increases the risk of human error, missed deadlines, and non-compliance penalties. Chekku’s automation reduces these risks by managing compliance tasks digitally.

How does compliance automation benefit my business?

Compliance automation improves efficiency, reduces errors, and saves businesses time and money. Chekku offers compliance automation tools that handle tasks like regulation tracking and report submissions.

What are the consequences of non-compliance in Australia?

Non-compliance in Australia can lead to heavy fines, legal action, and business shutdowns. Chekku ensures that your business meets all regulatory requirements to avoid these consequences.

How can Chekku help with compliance monitoring?

Chekku provides continuous compliance monitoring, sending real-time alerts to businesses when compliance actions are needed, helping prevent non-compliance before it becomes an issue.

Is compliance automation necessary for small businesses?

Yes, small businesses benefit from compliance automation as it reduces the complexity of managing regulatory requirements. Chekku offers an easy-to-use platform to automate compliance tasks, making it essential for business growth.